he Pawffice is back! I’ve been busy the last few months helping out at the firm that I haven’t been able to write, but that all changes now! I’m here to talk about the difference between employees and independent contractors. People get this confused all the time just like how I get confused when someone on TV rings the doorbell or when someone in real life rings the doorbell. I still go absolutely crazy either way, but that doesn’t mean it isn’t confusing.

I’ve talked to our wage and hour attorney Philip Oliphant about the key differences between them. That way, we can make sure people aren’t misclassified as an independent contractor when they really should be an employee.

What is an independent contractor?

Independent contractors are not considered employees. According to the IRS, “if you are an independent contractor, then you are self-employed.” Employers can’t tell independent contractors how they have to work or on what time. They enforce the final product and deadline.

Since I’m paid in treats does that mean I’m an independent contractor? No. I cannot be self-employed. That is far too much responsibility. I can’t pay bills off of just treats. I’m reminded every day from the humans I live with that I am a bill myself.

More importantly, I am only employed by The Crone Law Firm. Independent contractors can work for more than one company as they are contracted by the companies. I don’t want to work for another company. What if someone at another office is allergic to me? That would be a problem.

Tax Difference Between Employees and Independent Contractors

As a dog, the only tax that I have to deal with is the Cheese Tax. Real ones know what I’m talking about. Employees and independent contractors are both taxed differently. Employees receive a W-2 tax form while independent contractors receive a 1099. What’s the difference?

Employees will have some of their taxes withheld while independent contractors will not. This is really important because it saves a lot of money for the business if they classify certain employees as independent contractors when they are actually employees. They don’t have to pay health insurance, withhold taxes, or contribute to independent contractors’ 401ks.

How Can You Tell the Difference Between an Independent Contractor from an Employee?

A business needs to know the difference between employees and independent contractors. It would be like if I didn’t know the difference between poodles and doodles. Look at this picture with me and my friend Bear who is a mini goldendoodle. We are both fuzzy, we both love treats, and we both like to bark at squirrels. That doesn’t mean that we’re both the same thing.

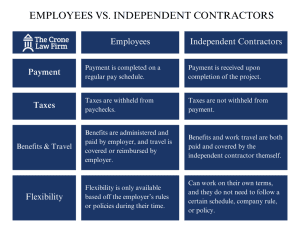

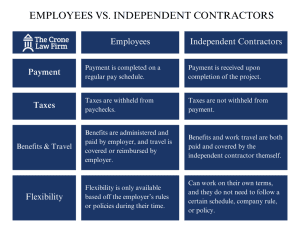

I’ve made a graph that helps illustrate the differences. I’m being told by our attorneys that I need to be clear that there are more differences, but these are the big ones.

What Could Happen If an Employee is Misclassified as an Independent Contractor?

If an employee is misclassified as an independent contractor, then the company can be in trouble like I am when I try to pull the human’s arm off while we’re walking and I see a squirrel.

There could be a big problem with the employee’s pay if they are misclassified. Some employees can be liable to receive overtime from their company if they are misclassified because they may have worked more than 40 hours in a work week. The company could also face bigger penalties like when I’m in time-out if the employee can show that it was intentional.

There is a new federal law affecting independent contractors that goes into affect in March! Make sure you have your employees classified properly.

The Pawffice

Thank you for reading my latest blog! I haven’t been able to write them in a little while, but I’m hoping to get them started up again. The lawyers want me to make sure to link here to our overtime blog page, so you can learn more details about all things wage and hour from someone other than a dog. Give us a call if you or someone you know may be misclassified or if you own a business that may need to look at their classifications.